Cost of Preferred Stock Formula

Preferred dividend Par value x Rate of dividend x Number of preferred stock. Each share currently sells for 80.

7 Of 17 Ch 14 Cost Of Preferred Stock Explanation Example Youtube

Similar to bonds preferred stocks are rated by the major credit rating companies.

. Calculate the proceeds from the sale and then divide it into the dividend per share for the after-tax cost of preferred stock. 110 975 113 percent. However the cost of preferred stock still.

Formula for Cost of Preferred Stock. Where the dividend is expected dividend. Calculate the cost of preferred stock.

Current Market Price 80. Net proceeds from issuance of. The formula for the.

Cost of Preferred Stock 400 1 20 5000 20. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. Find Todays Best Dividend Stocks Ex-dividend Dates and Stock Data.

For example if ABC Company pays a 25-cent dividend every month and the required rate of return is 6 per year then the expected value of the stock using the dividend. The cost of preferred stock is equal to the preferred stock dividend per share DPS divided by the price per preferred share at which the preferred stock was issued as a dividend. Cost of Preferred Stock for Shares Dividend Market Price.

Number of preferred stock 2000. D 20. Along with its formula and types of preferred stock𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐨𝐬𝐭 𝐨𝐟 𝐏𝐫𝐞.

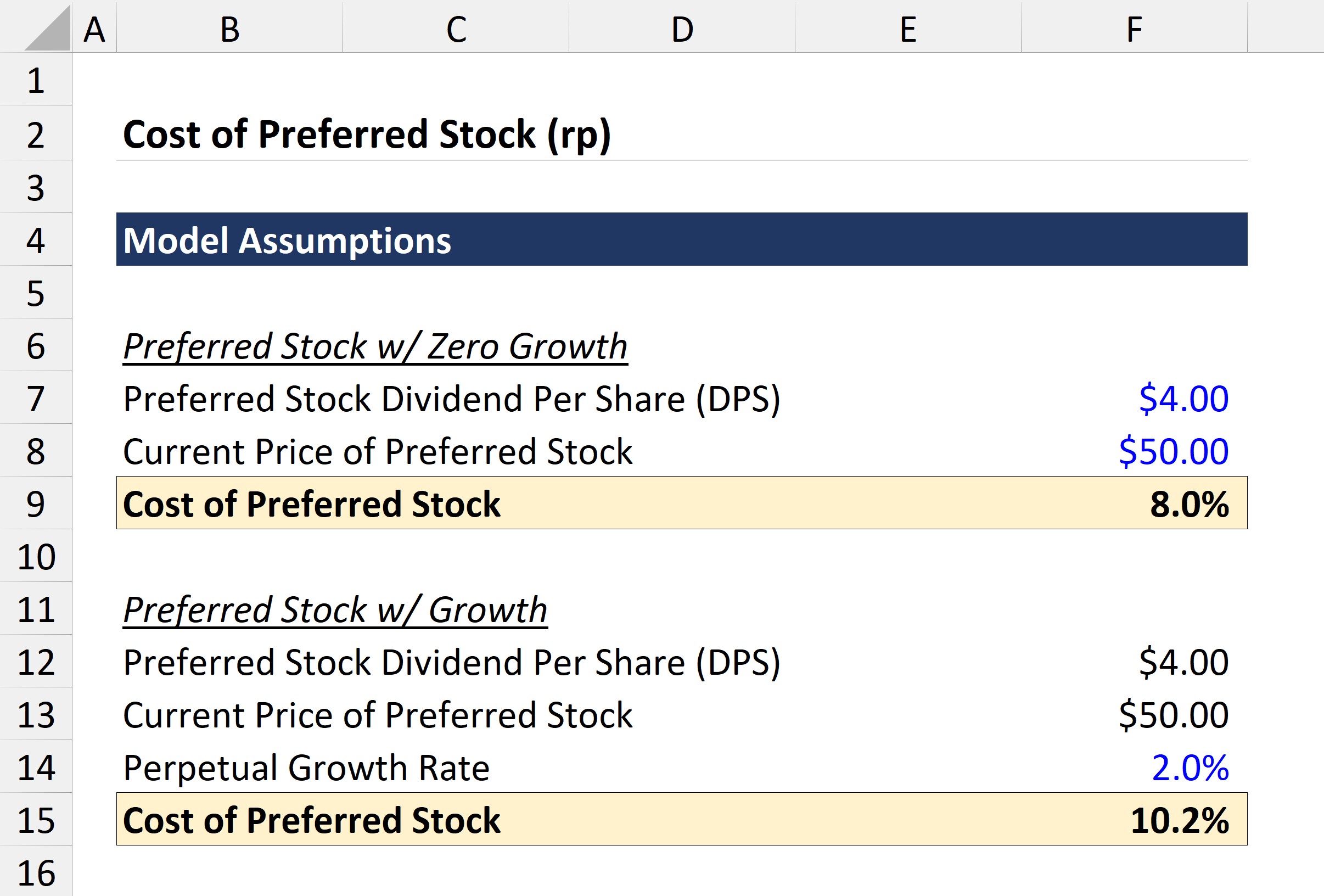

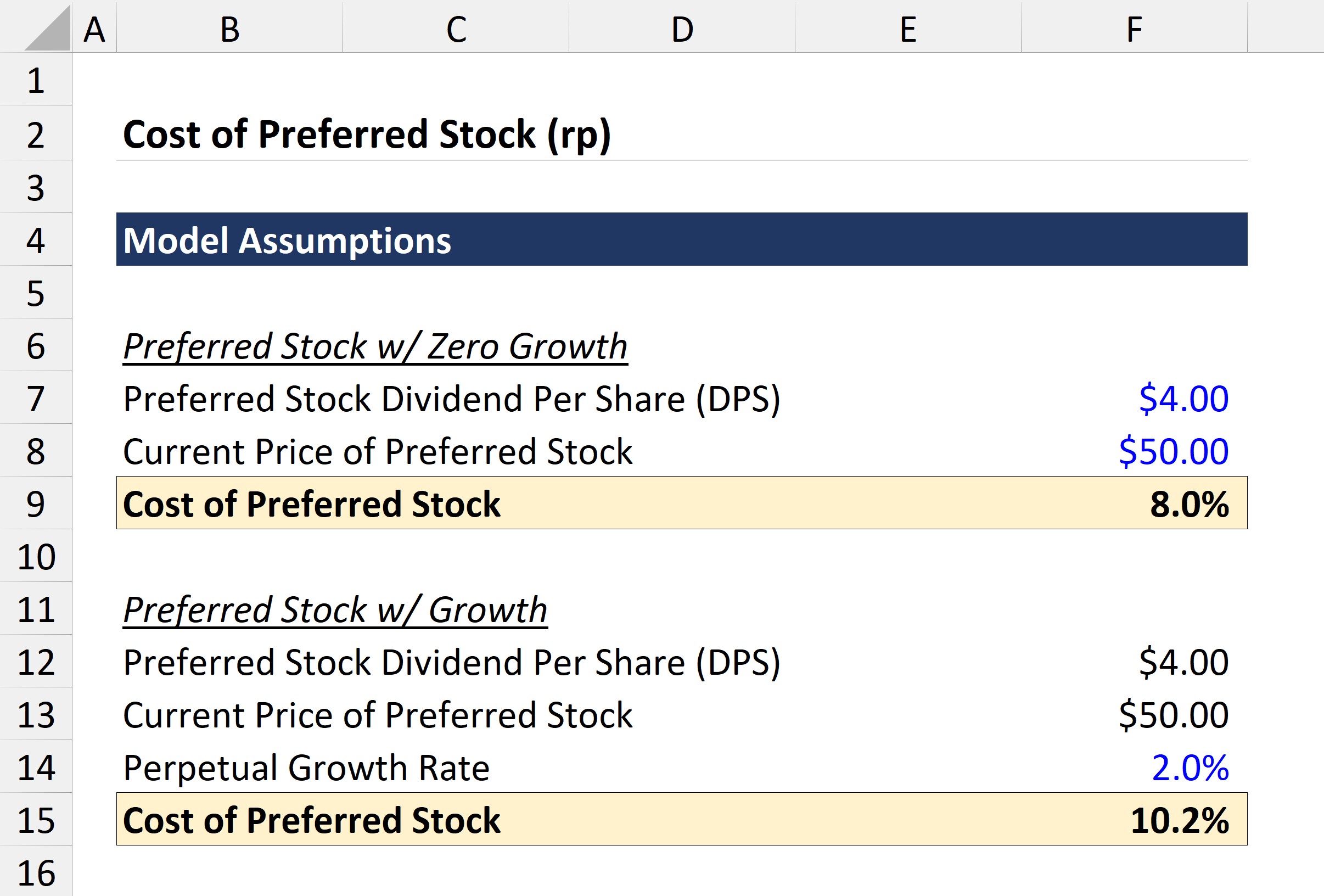

Ad Diversify your portfolio with guidance from investment professionals. Company A has preferred shares worth dividends of 5 per year. The formula used to calculate the cost of preferred stock with growth is as follows.

Cost of Preferred Stock 3 25 12. In this case the cost of preferred stock 𝑅 𝑝 𝐷 𝑃 0 300 2500 12. Ad Build Your Portfolio Your Way.

Choose Investments Using 0 Online Stock and ETF Trades. This is the after-tax cost of. Rps cost of preferred stockDps preferred dividendsPnet net issuing price.

Cost Of Preferred Stock Rp Formula And Calculator Excel Template Bagikan Artikel ini. Formula for the CPS is as under. Iklan Tengah Artikel 1.

The cost of preferred stock is simple and it is calculated by dividing dividends on preference shares by the amount of preference share and expressed in percentage. Company A has 2500000 shares of preferred stock outstanding with a 10 face value and an annual fixed dividend rate of 925. The formula above tells us that the cost.

Usually the management of a company decides the investment options and chooses the best option of. As the preferred stocks are currently outstanding thus we can calculate the cost of preferred stock by using the below formula. Cost of Preferred Stock D P0.

In this video we are going to learn what is cost of preferred stock. Par value 20. Lets say a companys preferred stock pays a dividend of 4 per share and its market price is.

Dividends on Preferred Stock 5. It is calculated by dividing the. Unlike bonds preferred stock dividend payments are not tax-deductible.

Wide Range Of Investment Choices Including Options Futures and Forex. Rate of dividend 3 100 003. The current market price of the security is 825.

Heres where we think you should invest. Extra money in your bank account. Preferred stock dividends Represents the guaranteed dividend paid to preferred shareholdersA growth rate can be included in the part of the formula.

Some people consider the preferred stock to be more like debt than equity.

Cost Of Preferred Stock Equity Financing In Startups Plan Projections

How To Calculate The Cost Of Preferred Stock Universal Cpa Review

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

0 Response to "Cost of Preferred Stock Formula"

Post a Comment